E-Invoicing in Saudi Arabia

Welcome to FATOORAH – your path to electronic invoicing in Saudi Arabia

Since December 2021, Saudi Arabia has been moving forward with the groundbreaking FATOORAH project to make the use of electronic invoices (e-invoices) mandatory for companies. This innovative initiative, launched by the Saudi Arabian tax authority ZATCA (The Zakat, Tax and Customs Authority), covers various transaction types.

Time frame

- From then on January 1, 2023 Companies with a taxable turnover of over three billion Saudi riyals in 2021 are required to issue electronic invoices and connect to the ZATCA portal.

- From then on July 1, 2023 Companies whose VAT subject profit exceeds 500 million Saudi Riyals must join ZATCA.

- From then on October 1, 2023 Companies with an annual turnover of more than 250 million Saudi Riyals in 2021 and/or 2022 are required to send their invoices to the ZATCA platform.

- From then on November 1, 2023 The obligation concerns companies with an annual turnover of more than 150 million Saudi riyals in 2021 and/or 2022.

- From then on January 1, 2024 Companies with an annual turnover of more than 70 million Saudi Riyals in 2021 and/or 2022 are required to use the ZATCA platform.

- From then on February 1, 2024 Companies with an annual turnover of more than 50 million Saudi Riyals will be required to connect to the ZATCA portal to send invoices.

- From then on March 1, 2024 The obligation concerns companies with an annual turnover of 40 million Saudi riyals.

- From then on June 1, 2024 Companies with an annual turnover of more than 30 million Saudi Riyals must send their invoices to the ZATCA portal.

applicability

E-invoice covers various transaction types including Business-to-Business (B2B), Business-to-Consumer (B2C) and Business-to-Government (B2G).

format

E-invoices in Saudi Arabia are only possible UBL-XML or PDF/A-3 format with embedded XML permitted.

Electronic signature

An electronic or digital signature for electronic invoicing is causing obligation.

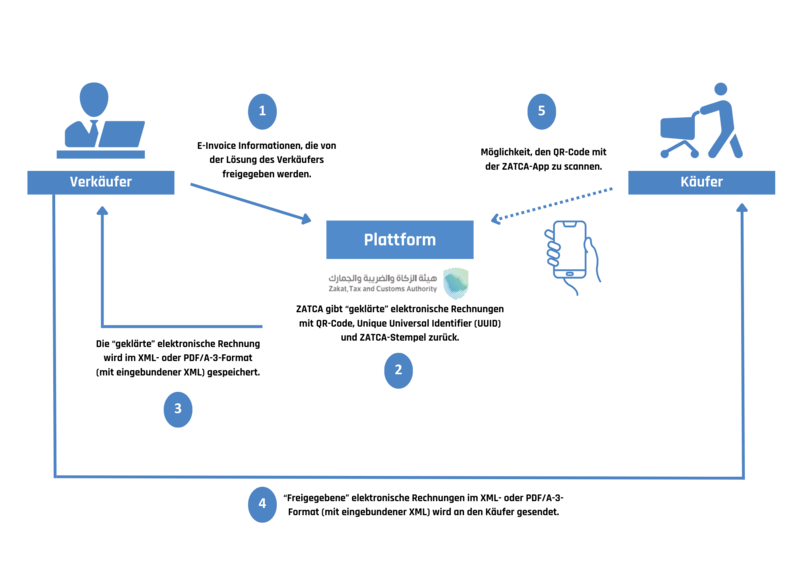

How e-invoicing works

Further information

https://zatca.gov.sa/en/E-Invoicing/Pages/default.aspx

___________________________________________________________________________________________________________________________________________

GOpus® eInvoice

Our GOpus® eInvoice solution can be integrated into SAP ERP and SAP S/4HANA and supports the creation of outgoing e-invoices in all international country formats. In this way, all your invoice contents can be created and sent between different international invoice issuers and recipients directly from your SAP system and all invoice documents can be archived in comprehensive monitoring. Integration into the SAP modules SD, FI, IS-H, IS-U and SAP Service Invoicing is possible. Further integrations are available on request.

You can find more information about our e-invoicing solution here ->